Understanding Bitcoin Structure in 5 Minutes

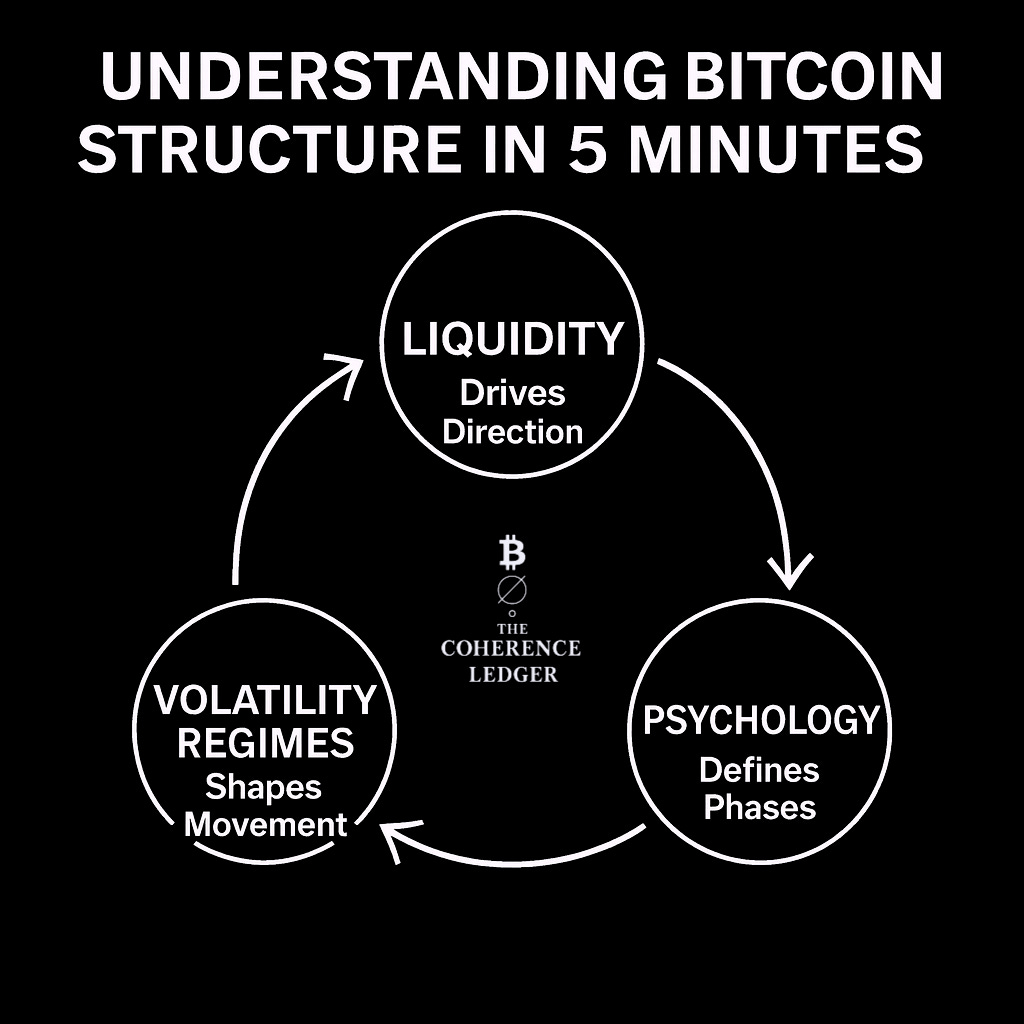

Track these five layers → the market stops looking like noise and starts looking like structure.

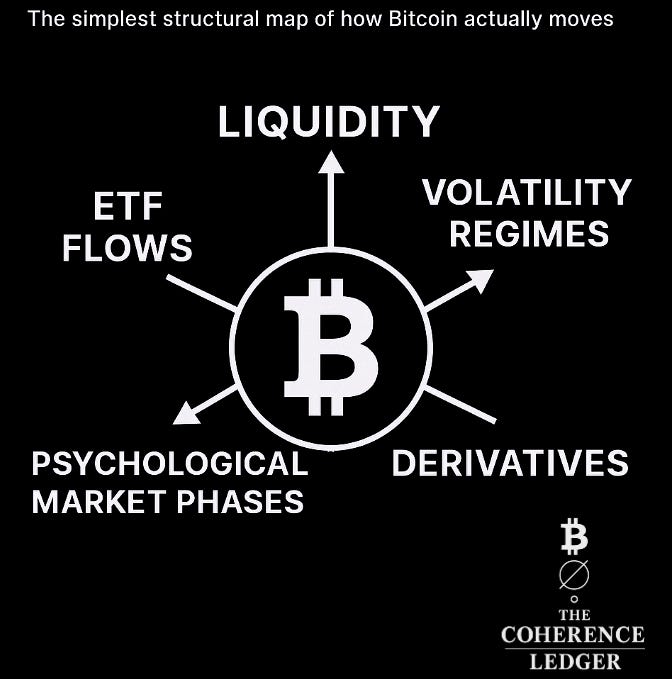

The simplest map of how Bitcoin actually moves and why most people get it wrong.

At first, some personal words:

My Working Credo

You are not here to follow a narrative,

but to organize reality in a way that holds under pressure.

This applies across everything I study and write about—Bitcoin, capital flows, macro cycles, shifting institutions, cultural fragmentation, and the individual experience within that fragmentation.

Reality does not clarify itself through opinions.

It clarifies through structure.

When pressure rises, narratives collapse first.

What remains is what was structurally true.

To think clearly when movement accelerates,

to act when others hesitat and

remain stable while environments destabilize—

that requires coherence, not conviction.

This credo is not about being right.

It is about being aligned enough

that decisions remain intact

when conditions change.

That is the standard I write from

and the frame I work within.

Florian Jumel

Right now, many people feel that everything is becoming unstable:

prices move rapidly,

politics polarizes,

institutions lose authority,

culture fragments.

This isn’t random chaos.

It is restructuring.

Here is the simplest map to understand what is happening whether you’re just trying to orient yourself personally, running a company, or making long-term financial decisions.

Understanding Bitcoin Structure in 5 Minutes

Most people try to understand Bitcoin through price, narratives, or cycles.

But Bitcoin doesn’t move because of stories.

It moves because of structure.

If you understand the five structural forces below, you understand 80% of Bitcoin’s behaviour in any cycle, under any narrative, across any regime.

Liquidity

The Engine Beneath Every Candle

Bitcoin is a liquidity mirror.

When global liquidity expands → Bitcoin breathes out.

When liquidity contracts → Bitcoin compresses.

This one force overrides:

• news

• narratives

• short-term hype

• retail sentiment

Liquidity explains why Bitcoin accelerates in easing environments and labours when the dollar strengthens or yields rise.

Liquidity is the frame. Everything else sits inside it.

Volatility Regimes

The Shape of Movement

Bitcoin doesn’t move randomly. It moves in regimes.

Expansion

• high volatility

• directional conviction

• clean breakouts

→ usually driven by liquidity return or strong demand flows

Compression

• low volatility

• tight ranges

• slow drift

→ often the result of strong dollar conditions, tight liquidity, or exhausted momentum

Compression is not weakness.

Compression is stored energy.

ETF Flows

The New Demand Map

Since 2024, ETFs reshaped Bitcoin’s structure. They function as a daily demand-and-supply gauge:

• inflows = structural bid

• outflows = structural drag

ETFs don’t “cause” volatility… they anchor it.

They reveal:

• when institutions accumulate

• when retail fear drains liquidity

• when price is out of sync with flows

In a market governed by institutions, flows > opinions.

A Common Misread

Many investors assume that positive ETF inflows must immediately translate into rising price.

In reality, structure has an order:

leverage must unwind

volatility compresses

flows accumulate

price expands

A recent example:

In early 2025, ETF inflows turned strongly positive while price barely moved.

That wasn’t lack of demand… it was leverage sitting on the wrong side.

When funding was negative and short-exposure clustered, the later rally wasn’t “new buying”…

it was risk being forced out.

Price was not “weak”.

Price was delayed by unwinding.

Understand this once, and you stop confusing compression for failure.

Derivatives

The Invisible Layer Moving Price

Bitcoin trades more through derivatives than spot.

This creates structural effects:

• funding imbalances

• leverage build-ups

• gamma squeezes

• liquidation cascades

• volatility traps

Bitcoin’s sharpest moves — up or down — often reflect risk being cleared, not fundamentals shifting.

To understand Bitcoin, you must understand where leverage sits and how it

unwinds.

Psychological Market Phases

The Human Layer

Bitcoin is also a nervous-system test.

Every cycle repeats emotional phases:

• disbelief

• cautious optimism

• euphoria

• denial

• fear

• capitulation

• quiet accumulation

Price expresses cognitive bandwidth:

When attention narrows → volatility rises.

When attention collapses → panic.

When attention stabilizes → accumulation.

This is not sentiment.

It is human processing speed made visible in price.

The Structural Summary

Bitcoin is a liquidity-sensitive, volatility-regime asset shaped by institutional flows, derivative positioning, and the psychological bandwidth of its participants.

Track these five layers → the market stops looking like noise and starts looking like structure.

A Common Beginner Misinterpretation

Most new investors think:

“If inflows are positive → price must rise.”

But structure has an order:

leverage must unwind

volatility compresses

flows accumulate

price expands

If you skip (1),

you mistake delayed structure for weakness.

If you see all four aligned,

you have clarity.

That’s all an entry-level investor needs.

The Coherencematrix in simple explanation

The Coherencematrix integrates:

• liquidity conditions

• volatility regime

• ETF flow direction

• derivative pressure

• psychological market state

It doesn’t predict price… it clarifies alignment:

Is Bitcoin moving with structure — or against it?

It turns volatility into information instead of intimidation.

That’s all you need to act with clarity instead of reacting to volatility.

Why This Matters

Most investors try to outsmart volatility.

Professionals track structure.

Structure simplifies everything:

• You stop reacting to single candles.

• You stop confusing noise for movement.

• You act when alignment appears, not when emotion spikes.

Bitcoin becomes readable.

Not predictable, readable.

If You Want the Deeper Structure

The Coherence Ledger covers the multilayer framework beneath this 5-minute map:

• Daily / Weekly / Monthly / Quarterly Compasses

• Stress & fragility zones

• Probability corridors

• Macro alignment

• Psychological layers

• Civilizational transitions

• ERCS research

No hype.

No predictions.

Only what remains true when stories collapse.

Coherence is your advantage.

Welcome inside the Ledger.

Understanding Modern Life in 5 Minutes

“Clarity emerges when we stop reading movement and start reading what makes movement possible.”

THE COHERENCE LEDGER FIRST READER GUIDE

Most readers arrive here at a moment when something is shifting — externally or internally. This guide gives you the structure to navigate that shift.

Thank you for reading!

May your patience be stronger than volatility, and your clarity deeper than conviction.

I hope this navigation gives you clarity and orientation. If you’re ready to move beyond noise and headlines, and want to navigate multi-layer through structural & psychological currents.

Everything free to read until 01.01.2026.

Coherence is your compass.

Join now. Don’t predict. Navigate. Structure thinks before reaction.

Florian Jumel

────────────────────────────────

The Coherence Ledger | Bitcoin Macro Navigation